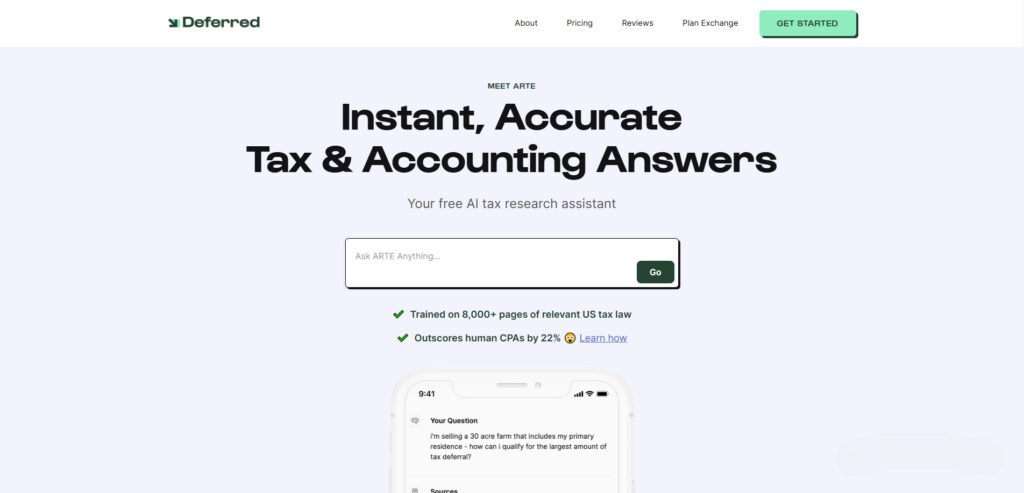

ARTE – Artificial Real Estate Tax Expert

![]() Free

Free ![]() USA

USA

What is ARTE

Discover the best local businesses in your area with our comprehensive directory. Find top-rated restaurants, shops, services, and more all in one convenient place. Start exploring today!